“Spot Trading in the cryptocurrency market: Understanding the fees and flow of order”

As the cryptocurrency market continues to grow in popularity, traders seek more effective ways to perform their crafts. One of the key components that enabled the crypto trading is the Spot market, where customers and sellers agree with a fixed price for property at some point.

However, with an increase in the trading video comes a lot of fees and costs that can eat in your earnings. In this article, we will explore the transaction fee related to the Spot trade of CRIPTO currency, as well as the dynamics of the order flow that affects market efficiency.

Transaction fees

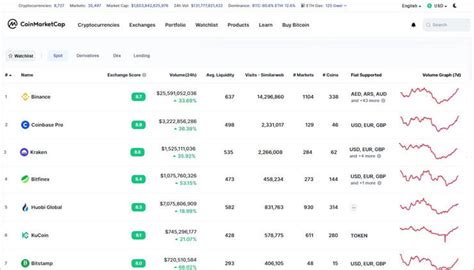

Transaction fees are the amount charged with exchanges for processing each store. They can vary significantly depending on the exchange, but here’s a general breakdown:

* Binance : 0.1% – 0.5% of transaction value

* COINBASE : 1.49% + $ 10 per transaction (based on USD)

* Kraken : 0.3% – 2.9% of a transaction value

Although these fees may seem small, they can be quickly added up when trade large quantities or often.

Order flow

The order course refers to the movement of the purchase order and the market sale. On the spot market, the flow of order is a net amount of order for buying and sales that are made on a specific time frame. This stream determines the price they are performed because the market participants respond to changes in offer and demand.

There are several key aspects of the flow of order:

* Depth of Order Book : Number of orders to buy and sell available for a particular assets can affect the flow of market flow and prices.

* Market Sentiment : Changes in investors’ attitudes towards property may affect the flow of order, with more optimistic or pessimistic investors, leading to increased purchase or sales pressure.

* risk management

: Effective risk management is crucial when trading on site. Order flow may indicate potential risks, such as excessive volatility or major prices.

How to communicate with transactions and order flow

The interaction between transaction and row flow fees is complex and influenced by a series of factors, including:

* ORDER SIZE : Smaller crafts are more expensive to process than larger ones.

* Market Conditions : Volatility and Communion Mood can affect the amount of orders made to buy and sell, which leads to changes in fees for transactions and order flow.

* Exchange algorithms : Some exchanges use sophisticated algorithms to optimize trade execution, which can affect the speed or efficiency of the craft.

Best Practice Practice on site

Although understanding of transactions and order flow fees are necessary, traders must also take steps to reduce their costs:

* Select low -fee exchanges : Explore each exchange to find one with minimal trading fees.

* Wisely use limited orders : Limited orders can help reduce the impact of major movements on the market on transactions fees.

* Follow your account activity : Review your trade history regularly and adjust your strategies if necessary.

In conclusion, the video trading the crypto currencies comes with its own series of costs and complexity. By understanding the transaction fee related to each exchange and dynamics of the order flow, traders can make more informed decisions when buying or selling property. Remember to always monitor your account activity and adjust your strategies accordingly to reduce risks and maximize profit.